Markets mixed as industrial production up, China woes persist

Wall Street opened higher Wednesday on strong industrial production data while Europe remained mixed following concerns about the Chinese economy and a further Fed rate hike.

Overall US industrial production rose by 1.0 percent in July, lifted by a 5.2 percent rise in the production of motor vehicles and parts, the Fed announced in a statement.

This was well above the median expectation of economists surveyed by MarketWatch, who expected a 0.3 percent increase.

"We think last month's increase will be reversed quickly as the industrial sector is poised to face multiple, intense challenges," Oxford Economics' lead US economist Oren Klachkin wrote in a note to clients.

European markets remained mixed following the release of UK inflation data showing it had dipped to a 15-month low.

The British pound strengthened on the inflation data -- although the UK still has the highest rate of inflation among G7 nations, and the drop might not be enough to prevent another rate hike next month.

"The result will likely elicit only a slight sense of relief in the government and at the Bank of England," said Richard Flax, Moneyfarm chief investment officer.

The eurozone's industrial production data, with 0.5 percent growth month-on-month in June, was also "surprisingly strong", according to Fawad Razaqzada Market Analyst, market analyst for City Index and FOREX.com.

Another focus Wednesday will be the release of minutes from the US Federal Reserve's July policy meeting, which investors will be scouring for insight on the bank's interest rate outlook.

Comments by Minneapolis Fed president Neel Kashkari on Tuesday also added to concerns that the US central bank is not yet done with rate hikes in its battle to tame inflation.

While inflation may be moving in the right direction, it is still higher than the Federal Reserve would like and it is too early to declare victory, said Kashkari, a member of the Fed's interest-rate-setting committee.

- Banks cut China forecasts -

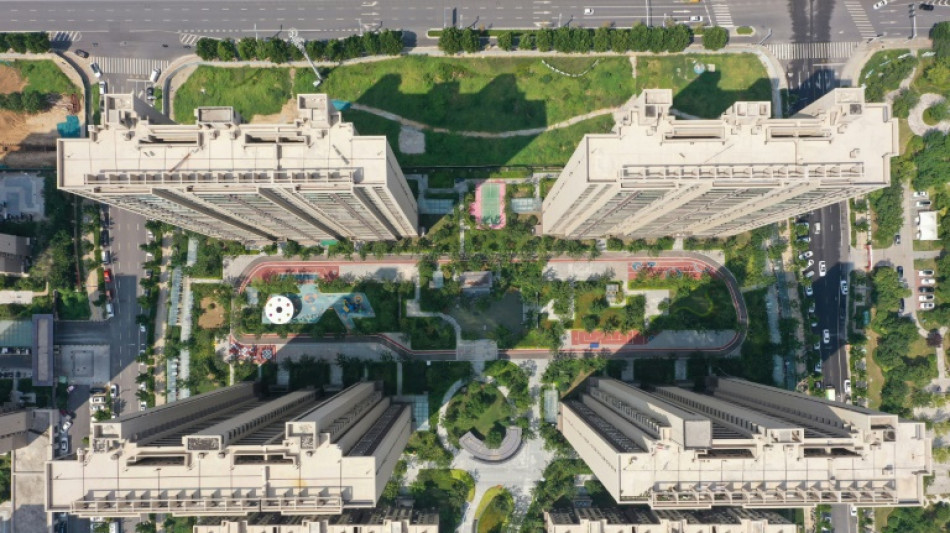

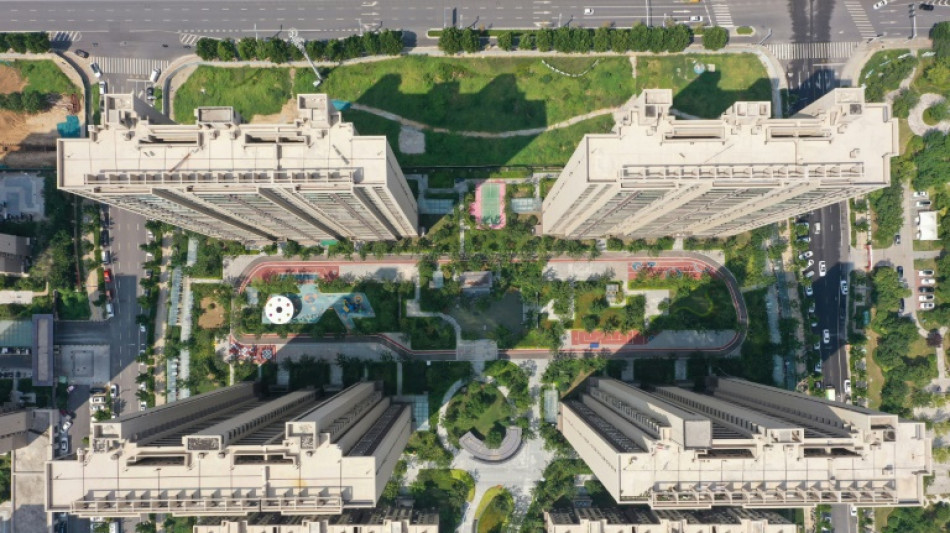

The Tuesday declines on Wall Street added to the risk-off sentiment in Asia Wednesday, with a further fall in Chinese new home prices in July fuelling concerns over the world's second-largest economy, which has stumbled since emerging from pandemic isolation.

Asian markets were well in the red, with Tokyo, Hong Kong, Seoul and Sydney all closing down more than 1.0 percent.

"Most Asian stocks experienced declines due to further deteriorating economic conditions in China," said Stephen Innes of SPI Asset Management.

"These concerns were exacerbated by resurfacing anxieties about a more aggressive stance from the US Federal Reserve, causing a wholesale lack of interest in high-risk assets."

Figures released Wednesday by China's National Bureau of Statistics showed new home prices declined for a second month in July in a further indication of the problems facing the deeply indebted property sector and the wider economy.

The data comes on top of a raft of weaker-than-expected figures on Tuesday showing slowing growth in retail sales and industrial production.

Several banks slashed their growth forecasts for China, with JPMorgan Chase cutting its estimate for 2023 to 4.8 percent, well below a May forecast of 6.4 percent, Bloomberg reported.

The recent data suggests China may struggle to achieve its official five-percent growth target set for the year.

The economy grew just 0.8 percent between the first and second quarters of 2023, according to official figures.

- Key figures around 1400 GMT -

New York - Dow: UP 0.3 percent at 35,015.94

London - FTSE 100: DOWN 0.5 percent at 7,351.66 points

Frankfurt - DAX: UP 0.1 percent at 15,784.57

Paris - CAC 40: DOWN 0.1 percent at 7,258.44

EURO STOXX 50: DOWN 0.1 percent at 4,282.84

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 18,329.30 (close)

Shanghai - Composite: DOWN 0.8 percent at 3,150.13 (close)

Tokyo - Nikkei 225: DOWN 1.5 percent at 31,766.82 (close)

Euro/dollar: UP at $1.0914 from $1.0905 at 2050 GMT on Tuesday

Pound/dollar: UP at $1.2753 from $1.2704

Euro/pound: DOWN at 85.54 pence from 85.82 pence

Dollar/yen: UP at 145.83 from 145.57 yen

West Texas Intermediate: DOWN 0.2 percent at $80.79 per barrel

Brent North Sea crude: DOWN 0.1 percent at $84.77 per barrel

E.Persson--RTC