Meridian Announces Fully Subscribed CAD 10m Non-Brokered Private Placement Financing & Outlines 2025 Programs

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

HIGHLIGHTS:

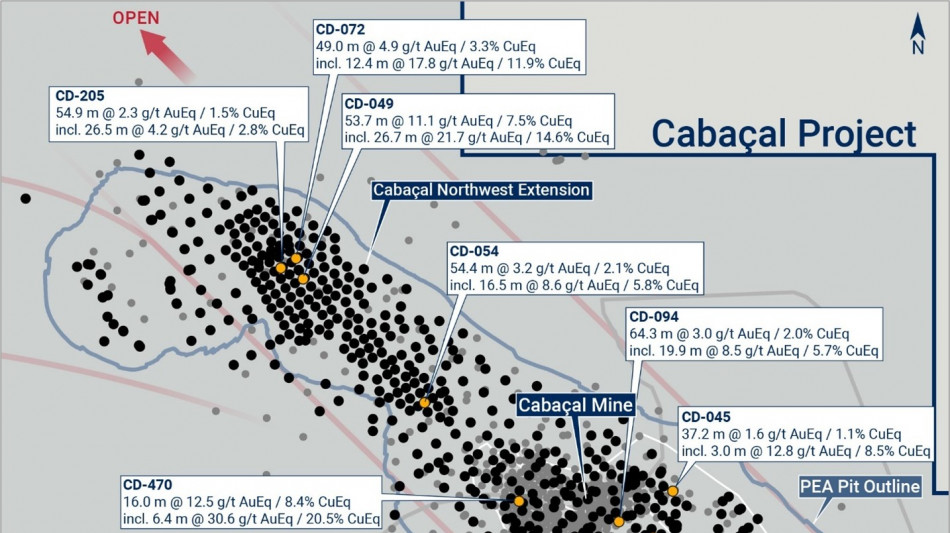

Meridian Mining plans transformational 2025 as an emerging Brazilian copper gold developer

Driven by its flagship Cabaçal Au-Cu-Ag VMS mine development and expansion programs

Resource growth from the Santa Helena infill and expansion program

Belt scale exploration program along 50km Cabaçal VMS Belt

CAD 10 million fully subscribed non-brokered financing at CAD 0.39

Subscribed by a single sophisticated European investor

Proceeds to be used to advance Cabaçal PFS completion, initiation of the subsequent Feasibility Study, expanded drill program at Santa Helena and regional exploration

LONDON, UK / ACCESS Newswire / January 28, 2025 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce its expanded plans for 2025 along with a strategic non-brokered private placement of CAD 10M (the "Private Placement"), fully subscribed by a single European investor increasing their stake to [12.1]%, as the Company continues towards its goal of being Brazil's next copper-gold producer.

Mr. Gilbert Clark, CEO, comments: "Meridian is now set for a potentially transformational 2025, led by its flagship project, the advanced Cabaçal Au-Cu-Ag project ("Cabaçal"). We are grateful for the considerable support from our European investor. On closing of the Private Placement, Meridian will have an enhanced working capital position well beyond the completion of Cabaçal's Pre-Feasibility Study ("PFS"), and with an expected positive report, will be substantially financed to initiate the subsequent Feasibility Study ("FS").

The PFS remains on schedule for reporting by the end of Q1 2025 and is expected to build on the confidence outlined in Cabaçal's PEA1, by increasing certainty, using a staged production expansion scenario, additional drill data, metallurgical test work, and other studies advanced and completed in 2024.

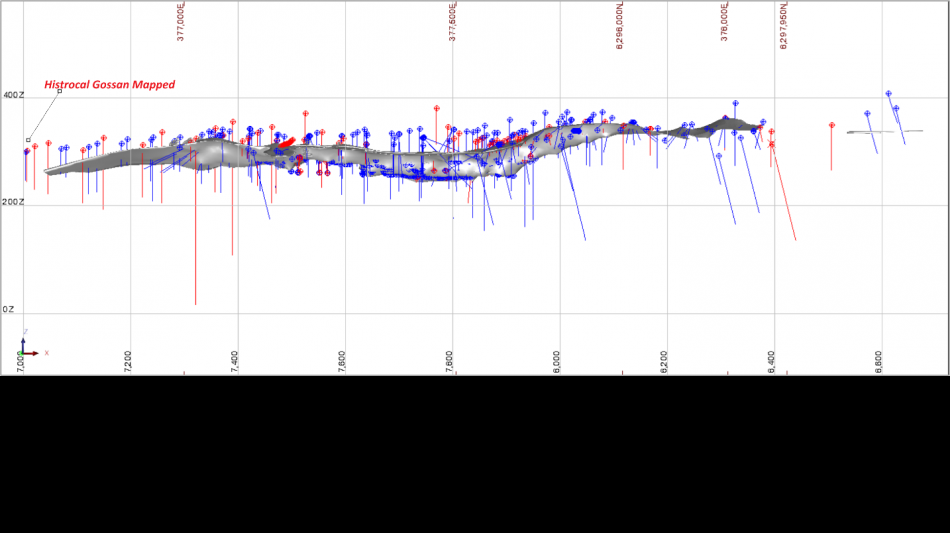

Meridian is focussed both on, developing Cabaçal's near-term potential to be Brazil's next Au-Cu-Ag mine, as well as testing the untapped exploration potential of the broader Cabaçal VMS belt ("the Belt). The potential of the Santa Helena Au-Cu-Ag & Zn deposit ("Santa Helena") as a future open-pit resource is advancing, illustrating the longer-term vision of the Company for a multiple mine along the VMS belt. Our discovery of the high-grade gold-silver VMS system in the western sector of Santa Helena in 20242, has locally changed the nature of the deposit's potential towards a more precious metal system. An extensive section of this open, high-grade gold-silver extension is hosted within the oxide and transitional layers ("Figure 2"), where Meridian currently has no metallurgical data. To avoid under-reporting the recoverable gold and silver mineralization at Santa Helena, the Company will complete additional metallurgical test work, before reporting the initial Santa Helena resource which is expected in Q2.

With the growing exploration potential of the Belt's southeastern zone centred on Santa Helena's open mineralization and its near-mine upside, Meridian will include into Santa Helena's Preliminary License submission's scope, the ability for the historical mine site to be re-established as a stand-alone processing facility, with associated infrastructure waste and dry-stack-tailing facilities.

Throughout 2025, Meridian's local team will continue to work professionally and safely to advance Cabaçal's and the belt's future, and to be actively engaged with the local communities. As a leading local employer, the Company is looking forward to continuing its support via direct and in-direct investments into the local economy throughout 2025."

1 Meridian Mining News releases March 06, 2023

2 Meridian Mining News releases November 20 and December 16, 2024

Cabaçal 2025 Outlook

Cabaçal's PFS is on schedule for reporting in Q1 2025. The Company has strengthened the geological controls by adding 37,000 additional meters of drilling and 53,000 assays to the database for geological modeling, resource estimation and infrastructure planning. Civil engineering, geotechnical, and hydrological studies to optimize the mine site's design input parameters have been completed. Metallurgical repeatability tests and sulphide reagent optimization have been concluded, and final reports are pending. On reporting of the Cabaçal PFS, Meridian anticipates the launch of Cabaçal's FS.

In 2025, the Company plans to complete an infill drill program of up to 4,700 metres, including areas of the deposit where historical drill hole data was only used for geological interpretation. The infill drilling will supplement and/or replace this historical data with mineralized intercepts. On receipt of the PFS's final geological model and mine plan, a limited grade control program centred on the future starter pit will be completed.

The Company has commenced the preparation for the next stage of permitting, assuming that the Preliminary Licence is granted in H1 2025. To this end, additional planning has been initiated for the supplementary data and reports needed to be submitted with Cabaçal's subsequent Installation License submission ("LI"; Licença de Instalação). This submission is planned for H2 2025.

Santa Helena 2025 Outlook

Santa Helena's resource program was expanded with the discovery of the western extension of shallow high-grade gold-silver dominant VMS mineralization reported late in Q4 20243. The immediate program is to test the metallurgical properties of this Au and Ag mineralization hosted within the oxide and transitional zones as no historical data exists for these zones. This program, testing the combined recovery processes for precious metals via gravity and then flotation, is ongoing.

The additional time needed to complete Santa Helena's full metallurgical programs, provides a short period of opportunity to further infill and expand drill coverage of Santa Helena. In consultation with Santa Helena's resource estimation consultants, Cube Consulting Ltd (Perth, Western Australia), this short, targeted drill campaign will also test a selection of historical holes for twinning and replacement of drill records from Santa Helena's database with partial sampling and limited geological input, thus improving the confidence in the geology and grade models for the Santa Helena deposit ("Figure 2"). The initial resource is scheduled for Q2 2025 with an updated resource in H1 2026. In total, the Company plans for up to 11,700m of drilling at Santa Helena in 2025.

3 Meridian Mining News releases November 20 & December 16, 2024

Non-Brokered Private Placement

Meridian has launched a fully subscribed non-brokered private placement of 25,641,025 common shares of the Company (the "Common Shares") at a price of CAD 0.39 per Common Shares for aggregate gross proceeds of up to CAD 10 million.

Pursuant to the Private Placement, a single strategic European investor has subscribed for 25,641,025 Common Shares. Prior to the Private Placement, the European investor-owned 4.6% of the Company. Upon closing of the Private Placement, the European investor will become a new insider of the Company owning approximately 12.1% of the Company on a non-diluted basis

The net proceeds from the Private Placement are expected to be used in advancing the Cabaçal's PFS, initiate the FS and related programs as well as associated resource and exploration activities of the broader Cabaçal Cu-Au-Ag VMS belt, regional targeting, and for working capital and general corporate purposes.

The Private Placement is expected to close during the week of February 17th, 2025, and is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals, including the acceptance of the Toronto Stock Exchange.

Securities to be issued pursuant to the Private Placement will be subject to a four-month hold period under applicable securities laws in Canada.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or the securities laws of any state of the United States and may not be offered or sold within the United States (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR ("Table 1") from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca .

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: [email protected]

Ph: +1 778 715-6410 (BST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

SOURCE: Meridian Mining UK S

View the original press release on ACCESS Newswire

Ch.Jacobs--RTC